J.P. Morgan Chase eyes expansion to the European Union

J.P. Morgan Chase eyes expansion to the European Union, BaFin extends measures at N26 to prevent money laundering, and Societe Generate gets France’s first crypto license

Hi!

Welcome to the new issue of the “Banking Bulletin” newsletter, which is my attempt to learn more about the European banking industry. Here is what happened last week:

J.P. Morgan Chase eyes expansion to the European Union,

BaFin extends measures at N26 to prevent money laundering, and

Societe Generate gets France’s first crypto license

Thanks for reading and have a great week!

Jevgenijs

p.s. have feedback? message me on Twitter

J.P. Morgan Chase Eyes Expansion to European Union

J.P. Morgan Chase Bank's CEO, Jamie Dimon, confirmed that the bank will be expanding its online bank, Chase, to Germany and other European Union countries. JPMorgan had previously entered the UK market with a digital-only retail offering in 2021 and expressed intentions to expand to other countries. While the timing of the expansion is still undecided, Dimon stated that they have ambitious plans for this move. The expansion aims to increase competition for European rivals in the crowded market and target medium-sized firms in Europe's largest economy.

“It has always been clear to us that we want to introduce Chase not only in the U.K., but also in Germany and other European countries,” Dimon told the German newspaper Handelsblatt. Last year, Reuters reported that J.P. Morgan was looking to hire a financial crime compliance officer "for the international consumer expansion in Germany". J.P. Morgan, which has its European Union hub in Frankfurt, has emerged as one of the leading advisory banks in the country. In recent years, the bank has been expanding its presence to focus on serving medium-sized firms, which are a crucial component of Europe's largest economy.

In just twenty months since its launch in September 2021, Chase UK has acquired over 1.6 million customers and $20 billion in deposits. The company’s mobile app has a rating of 4.8 in Google Play store, and a rating of 4.9 in Apple App Store, as well as won the Best British Bank honor at the 2023 British Bank Awards ceremony. The company expects to break even in the United Kingdom in 2027.

✔️ JPMorgan to expand online bank Chase to Germany, EU

✔️ Dimon confirms JPMorgan’s plan to launch digital bank in Germany

✔️ JPMorgan readies overseas retail expansion with German hiring spree

✔️ Chase UK hits £15bn, reaches 1.6m customers

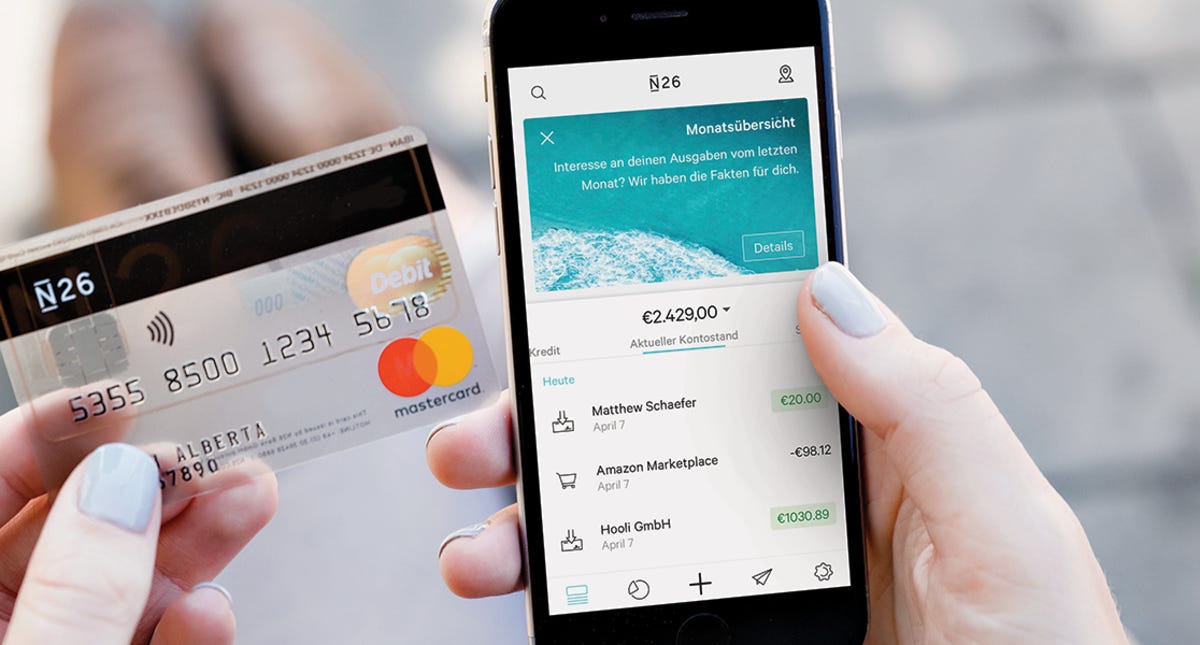

BaFin Extends Measures at N26 to Prevent Money Laundering

German financial regulator BaFin has extended its measures at the online bank N26 to prevent money laundering. These measures, in place since 2021, include having a special monitor at the bank and limiting new customer intake to 50,000 per month. Despite some progress, BaFin has identified deficiencies in N26's systems. N26, with over 8 million customers across 24 countries, has stated that it has invested significantly in anti-money laundering measures and is committed to complying with the order as quickly as possible.

In March, The Financial Times reported that Thomas Grosse, the Chief Risk Officer of N26, has resigned for personal reasons, marking the third high-level executive departure in less than a year. Grosse, responsible for governance, compliance, and risk, was one of the two executives with the necessary regulatory clearance to run a bank in Germany. His exit adds to the leadership crisis at N26, which has also seen the departure of the Chief Operating Officer and Chief Financial Officer in previous months. This series of exits raises concerns about the company's internal governance, especially as it faces regulatory pressure.

✔️ N26 receives updated order on the prevention of money laundering

✔️ German watchdog extends measures at N26 to prevent money laundering

✔️ N26 head of risk quits due to personal reasons in escalating leadership crisis

Societe Generale Gets France’s First Full Crypto License

Societe Generale Forge, the blockchain unit of Societe Generale, has been granted the first full license issued under France's new crypto regulations. While over 80 companies are registered with the country’s financial regulator, Autorité des Marchés Financiers, SG Forge is the first to secure the highest level of French regulatory certification for businesses in the crypto space. The license designates Forge as a digital asset service provider and enables it to act as a custodian for digital assets, facilitate the purchase and sale of digital assets with legal tender, trade digital assets with other digital assets, and handle third-party orders for digital assets.

This move marks Societe Generale's expansion into the digital asset space and will allow the unit to cater to the growing demand from institutional clients. The new Digital Asset Service Provider regime in France is more comprehensive than the previous registration process for crypto companies and aligns with the broader European Union’s Markets in Crypto-Assets (MiCA) rules that require all crypto providers to obtain a full license from a member state to operate in the bloc by January 2025. Markets in Crypto-Assets regulation was approved by the European Parliament in April 2023.

✔️ Societe Generale Unit Gets France’s First Crypto License

✔️ Société Générale’s Crypto Division Is First To Gain Full License From French Regulator

🇬🇧 Bank of England to check credibility of top banks' wind-down plans

The Bank of England will evaluate the "resolvability" plans of major banks, such as HSBC, Lloyds, NatWest, and Barclays, in October, following concerns raised by the forced takeover of Credit Suisse.

🇬🇧 UK tightens rules for bank account closures after blacklisting complaints

The UK government has introduced new rules to tighten regulations around bank account closures following complaints of blacklisting based on political views. Concerns arose when prominent Brexiteer Nigel Farage and others reported having their access to finance restricted.

🇪🇺 ECB to ask banks to provide weekly liquidity data to monitor their health

The European Central Bank (ECB) will require banks to submit weekly liquidity data from September onwards to closely monitor their ability to handle potential shocks amid rising interest rates.

🇩🇪 Deutsche Bank to Pay $186 Million Fed Penalty Over Controls

Deutsche Bank AG has been ordered to pay a $186 million penalty by the Federal Reserve as a result of a probe that revealed the bank's failure to address issues related to money laundering after previous violations.

🇩🇰 Danske Bank hikes guidance, resumes dividends

Danske Bank, Denmark's largest lender, announced on Friday that it has raised its full-year profit guidance and will resume paying dividends to shareholders. The decision came after the bank’s second-quarter earnings exceeded expectations.

🇬🇧 Virgin Money to shut a third of its UK bank branches

Virgin Money has announced plans to shut down 39 of its UK bank branches due to a decrease in footfall as more customers opt for online banking services. The closures, which represent a third of its branches, will put 255 workers at risk of redundancy.

🇬🇷 Greece to begin selling bank stakes this autumn

Greece is planning to commence the sale of stakes in its major banks in the upcoming autumn, according to insider sources. The decision comes as part of the country's efforts to reduce its debt and strengthen its financial sector.

Disclaimer: Information contained in this newsletter is intended for educational and informational purposes only and should not be considered financial advice. You should do your own research or seek professional advice before making any investment decisions.

Cover image source: J.P. Morgan